Overview: Our client, a pioneering financial holdings institution, faced challenges with accurately forecasting market trends and customer behaviors. Traditional forecasting methods were proving insufficient in capturing the complexities and rapid changes in the financial markets. They sought a solution to improve their forecasting accuracy and gain deeper insights into emerging trends.

Duration: 9 months.

Status: close to completion.

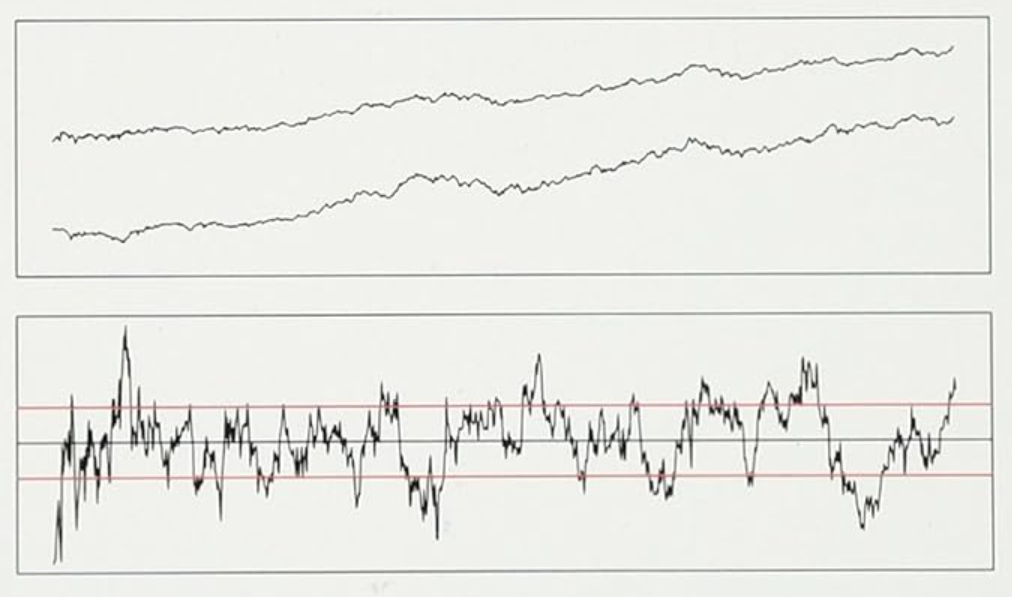

Solution: Through this collaboration, doralia AI implemented advanced AI algorithms designed to uncover hidden patterns and trends within their vast financial data sets. Our solution leveraged state-of-the-art machine learning models and big data analytics to enhance their forecasting capabilities.

Steps Taken

- Data Collection and Integration:

- Integrated data from various sources into a centralized, high-performance data warehouse.

- Collected historical financial data, market data, customer transaction records, and external economic indicators.

- Model Development and Training:

- Developed customized AI models tailored to the client’s specific needs, focusing on market trend analysis and customer behavior prediction.

- Trained models using historical data to identify patterns and correlations that traditional methods missed.

- Real-Time Analysis and Prediction:

- Implemented real-time data processing to ensure the models continuously learn and adapt to new data.

- Provided real-time forecasts and trend analysis to support immediate decision-making.

- Visualization and Reporting:

- Developed interactive dashboards to visualize trends, forecasts, and key insights.

- Enabled stakeholders to explore data through intuitive interfaces, facilitating better understanding and communication.

- Deployment and Monitoring:

- Deployed the AI models within the client’s existing IT infrastructure, ensuring seamless integration and minimal disruption.

- Continuously monitored model performance, making necessary adjustments to improve accuracy and relevance.

Results

- Enhanced Forecasting Accuracy: The AI models significantly improved the accuracy of financial forecasts, allowing the client to make more informed investment and strategic decisions.

- Increased Efficiency: Automated data processing and real-time analysis reduced the time and resources spent on manual data analysis and forecasting.

- Deeper Insights: The ability to uncover hidden patterns and trends provided the client with a deeper understanding of market dynamics and customer behaviors.

- Proactive Risk Management: Improved risk assessment and early identification of potential market disruptions enabled the client to take proactive measures, reducing financial risks.

Client Testimonial: “Our collaboration with doralia AI is transforming our approach to forecasting. The insights and accuracy we are gaining are unparalleled, enabling us to stay ahead in a competitive market. Their expertise in AI has been a game-changer for our strategic planning and risk management.”

CFO, Asset Management Firm

Discover how our advanced AI algorithms can enhance your forecasting accuracy and uncover hidden patterns within your financial data. Contact us today to learn more about our AI-driven forecasting and trend analysis services and how they can benefit your organization.